Safeguarding the Future

“We choose to do these things not because they are easy, but because they are hard; because that goal will serve to organise and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one we intend to win” (JFK)

Costs of Carbon are real

In 2022 we introduced our work on Carbon Value at Risk where we looked at the potential value destruction if companies were forced to suddenly pay for the costs of their carbon emissions. At the time, we were concerned about the introduction of aggressive legislation and how that might take companies by surprise if they weren’t preparing for it.

Post our late 2022 report, the new Labour government reformed the Safeguard mechanism in 2023. We took the opportunity at that point to review the covered facilities list, map the facilities to listed entities and compare this list to our portfolio holdings. We have used this list to selectively engage with companies to understand how they intend to tackle the decarbonisation journey ahead of them and importantly, how much its going to cost.

In late 2023, we also introduced a more granular assessment of company net zero plans in the Environmental component of our in-house ESG assessment. The aim of this enhancement is to be able to track how many of our companies are doing genuine work on climate change transition. We look at whether there is a net zero plan in place, whether it has a target net zero year and an interim target, the quality of the plan, percentage reduction from baseline and the measurement methodology (intensity or absolute).

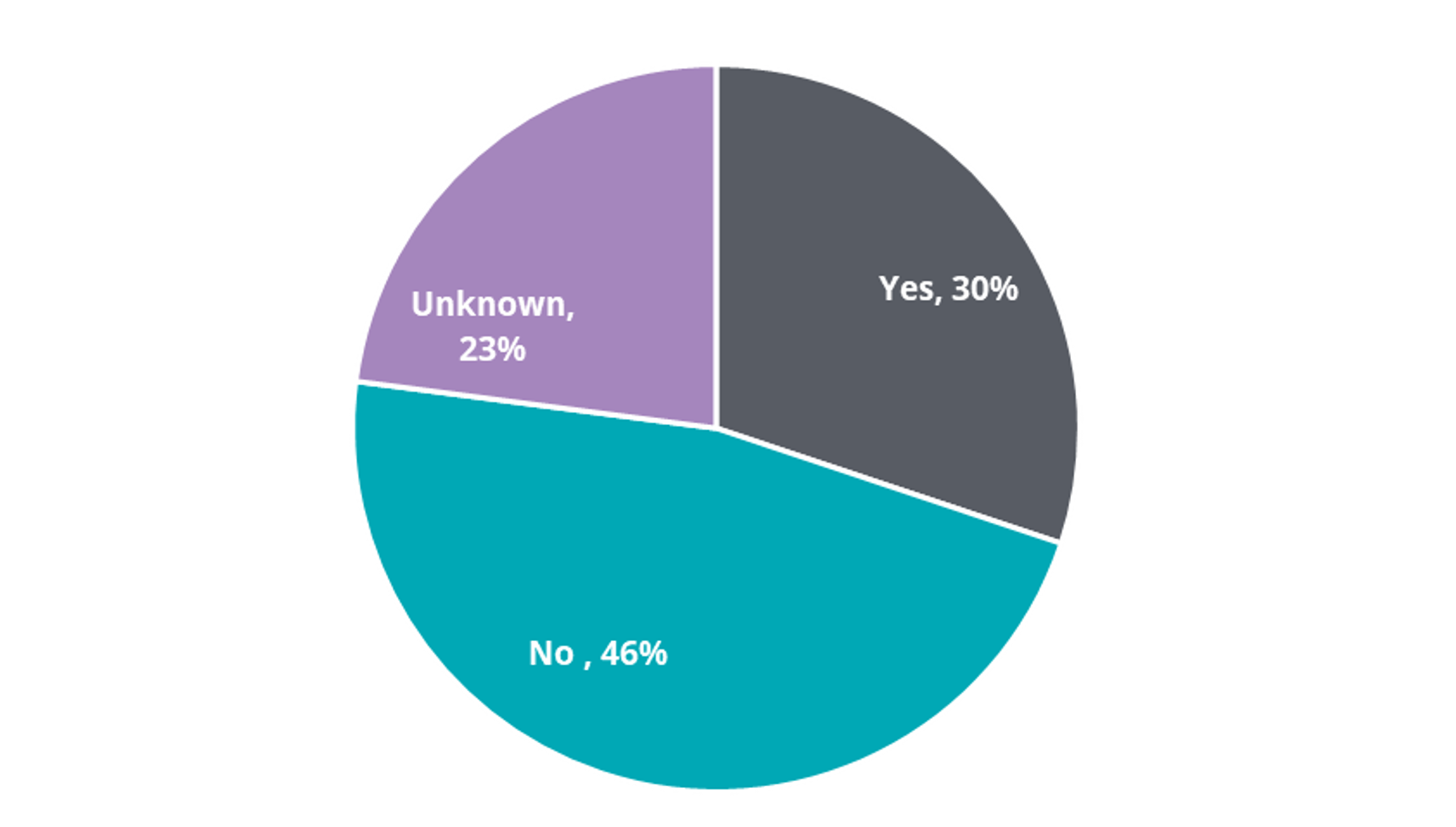

30% of our portfolio by weight have a net zero plan in place. Of the remainder, we know that 46% don’t have plan in place and 23% of the portfolio has an unknown status at this stage.

Source: Longwave, Company reports (Mar 2024)

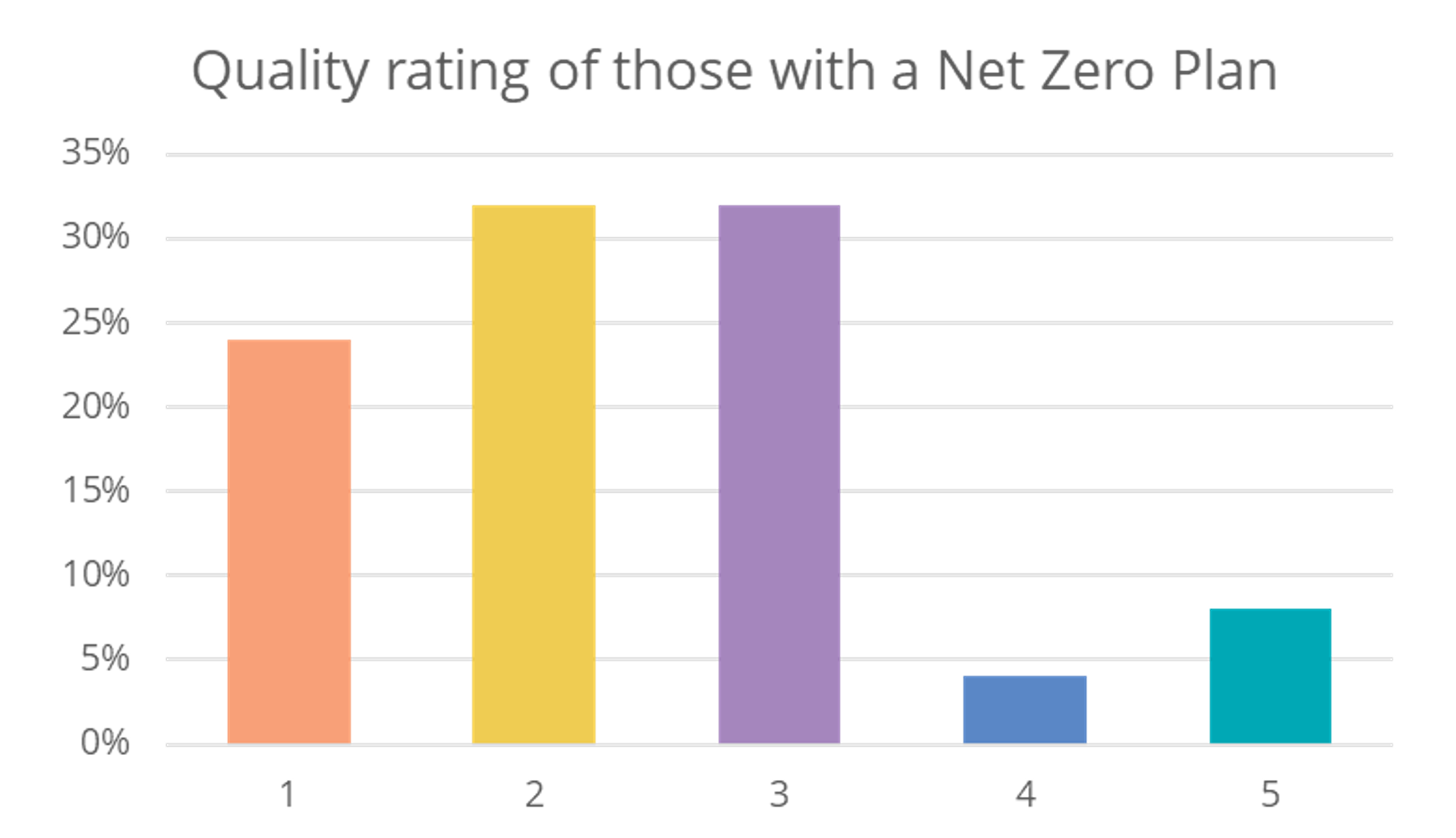

As part of this exercise, we’ve also made an assessment on the quality of the published net zero plans. In this rating structure, 1 is poor quality (very little in identified projects that make a meaningful difference to emissions or complete reliance on 3rd parties) and 5 is high quality (comprehensive disclosure on specific identified projects with clear steps to implementation and guided timeframes). Unsurprisingly, there are very few high quality Net Zero plans, and the bulk of those we looked at were average to low quality at best.

Source: Longwave, company reports (Mar 2024)

Safeguard facilities list – observations

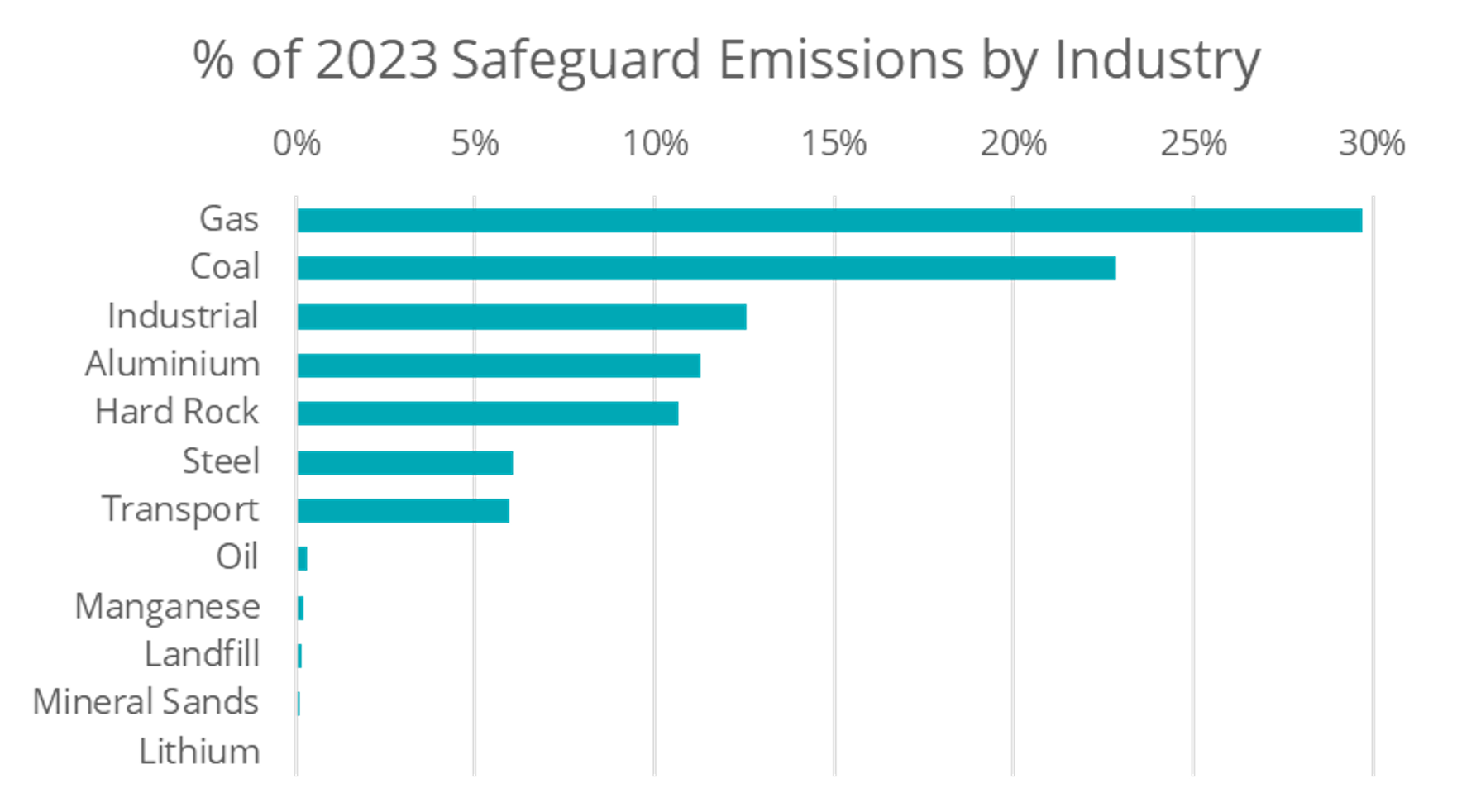

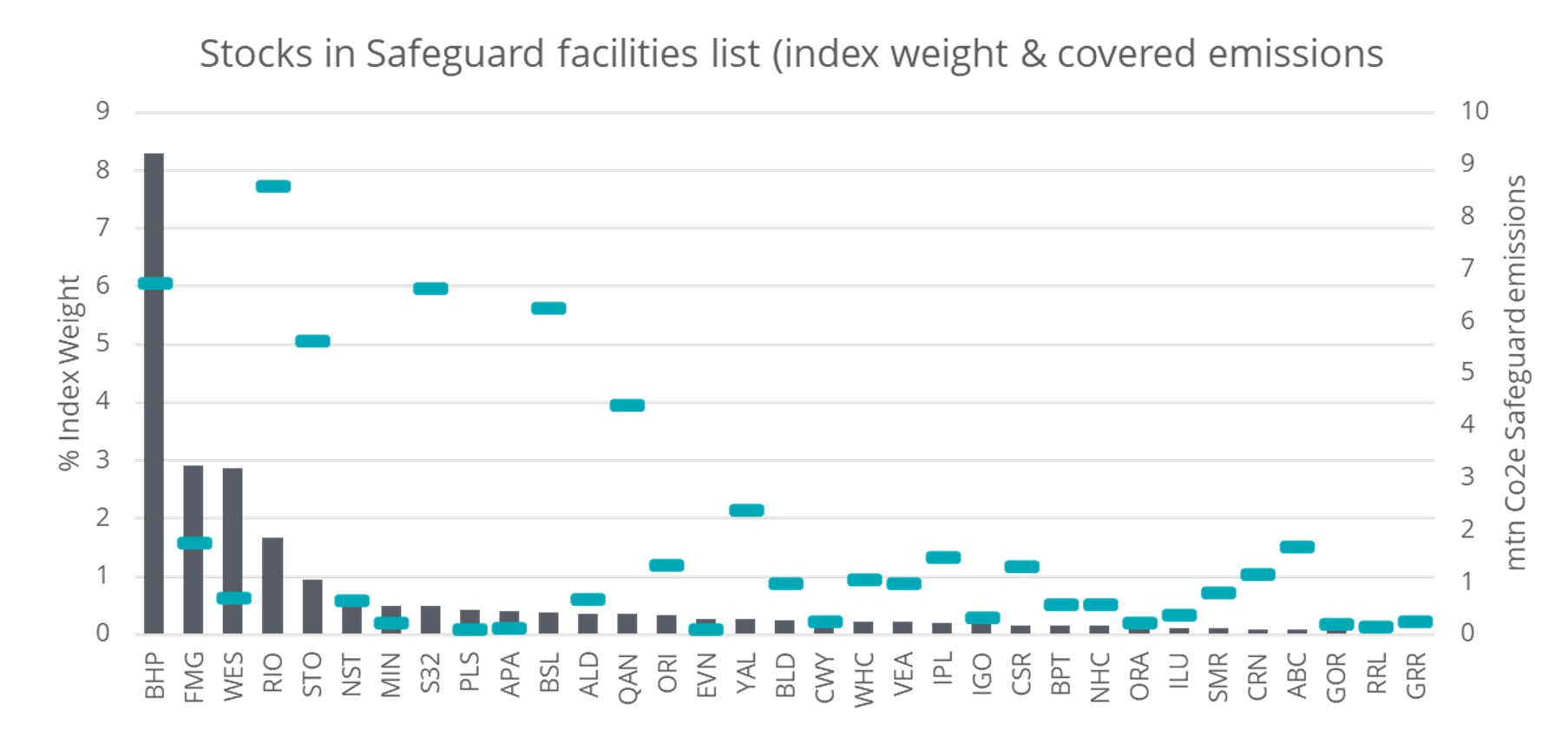

Of the 138mtn Co2e covered under the 2023 facilities list, approximately 58.6mtn of it belongs to 33 companies listed on the ASX. Of these, 6mtn Co2e belongs to 11 ex100 stocks of which Longwave owns 7.

As part of this exercise, we classified the emissions into end use industries. We found it interesting to see that 10% of the covered emissions occur in hard-rock mining (largely Iron ore and Gold). And we deliberately called out the small percentage of covered emissions from Lithium. This is a single open-cut lithium mine, but interesting, non-the-less to note some of the perverse aspects of decarbonization supply chains.

Source: CER, Longwave (2023)

Of the listed stocks on the Safeguard facilities list, there’s limited correlation between index weights and the absolute amount of covered emissions. As we observed in our carbon VAR work, emissions are driven more by the business model than the unit economics of the business itself.

Source: CER (2023), Longwave, ASX All Ords Index weights 31st Mar 2024

One other high-level observation we’d make is that It appears that many coal mines (in particular thermal) have changed hands into private or to offshore entities that may very well be less motivated to spend equity capital on innovative decarbonisation technology. We will be interested to see what solutions are adopted by private players vs their listed peers over time.

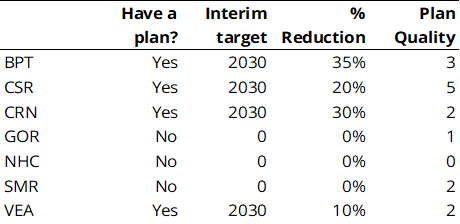

Net Zero plans for Longwave companies

In our engagement with companies since we undertook these two research efforts, we have been trying to get a better understanding of how our portfolio companies are planning on complying with the safeguard legislation. Our curiosity has also led us to engage with companies in various supply chains to understand the progress on industrial technology that is needed for these decarbonisation pathways.

The table below lists our assessment for the 7 portfolio companies that are on the Safeguard facilities list. The percentage reduction target relates to their 2030 interim target date and we have also shown our assessment of plan quality. You will see that two companies listed as not having a plan have provided enough information for us to do a quality rating. These companies have stated ambitions, but no commitment. In some cases they appear to have done quite a bit of background work on possible decarbonisation pathways, but there is little in the way of published information.

Source: Longwave, company reports (Mar 2024)

In our engagement with companies, we’ve learnt a few key things that will impact companies ability to comprehensively decarbonise their operations:

- Easy wins in Hard Rock and Coal mining tend to be renewable electrification of process plants. In many cases, this can be done using third party capital. However, due to power reliability requirements for process plants, fully renewable power is currently not economic (gas tends to be used to ensure power supply is completely reliable).

- Fleet decarbonisation (ie electrification) for all open pit and underground mining operations is at best a 2030 proposition. However, from our conversations with companies heavily involved in testing fleet technology solutions, we think its more likely that economic technology solutions won’t be available until the mid-2030’s or even later. Electric fleet solutions are likely to require complete mine re-designs along with wholesale fleet replacement. Underground mines are probably more likely to transition to electrification quicker given their fleets are smaller, lighter and they haul little to no waste rock (only ore).

- Fugitive emissions in coal mining can be a significant problem (and not all coal mines are made the same). Technology exists to partially deal with fugitive emissions from underground coal mines in an economic manner. However, the task in an open cut coal mine (advance coal seam gas production from future mining areas) is harder, and only in the testing phase.

- Capex required to implement near-term identified projects (even in the case of CSR who had the highest quality plan with identified projects) is so low as to be entirely digestible within BAU capex budgets. That said, we got the impression that companies are reluctant to work on the next leg of decarbonization projects because they don’t want to spend capital dollars on experimental technology.

Overall, we take heart that there is a lot of activity going on behind the scenes across a swathe of industries. However, our engagement so far has simply served to confirm our long-held view that the real task of decarbonising industrial supply chains is really hard and will take a lot longer than was originally envisioned.

Other thoughts on the real costs of climate change

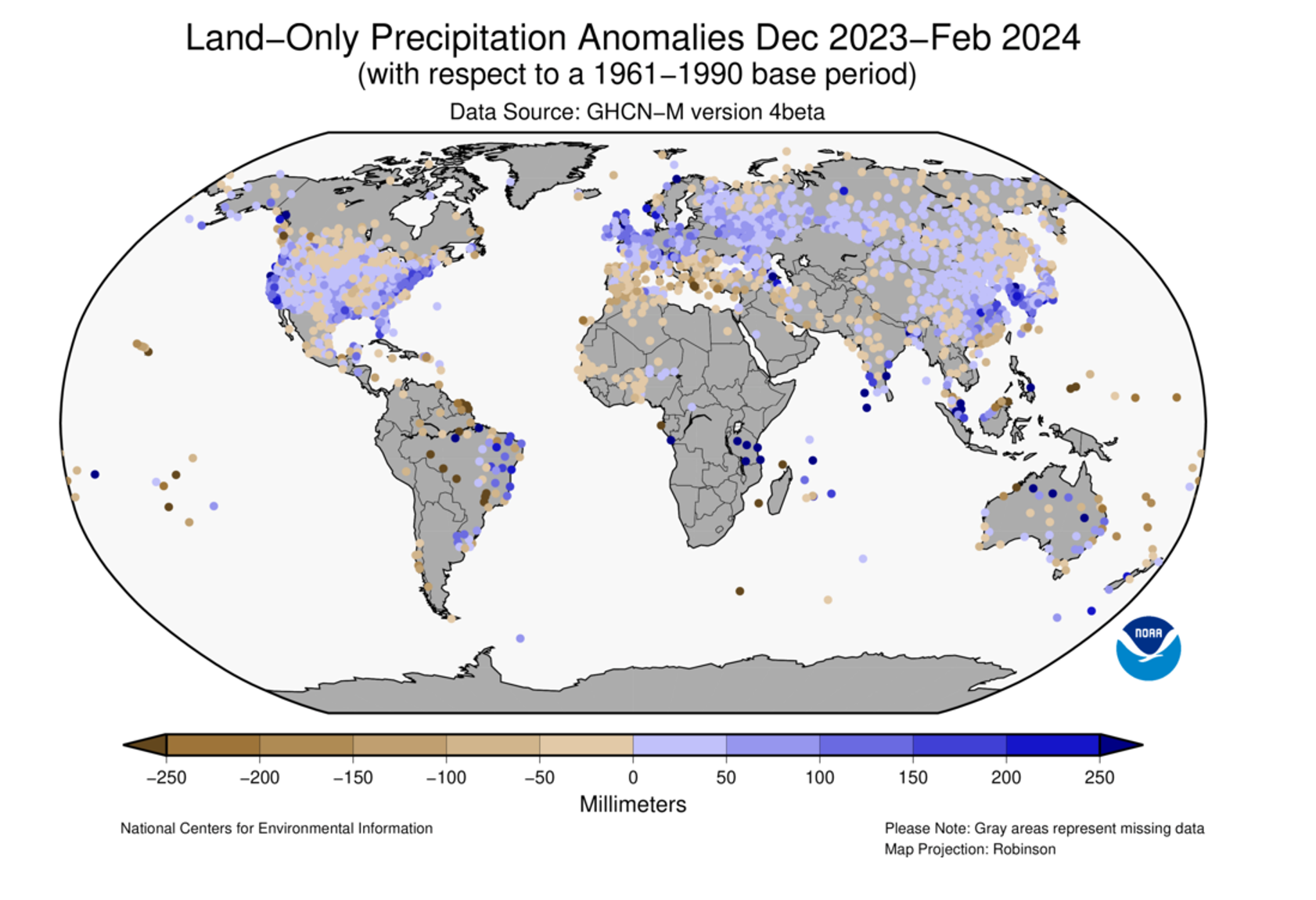

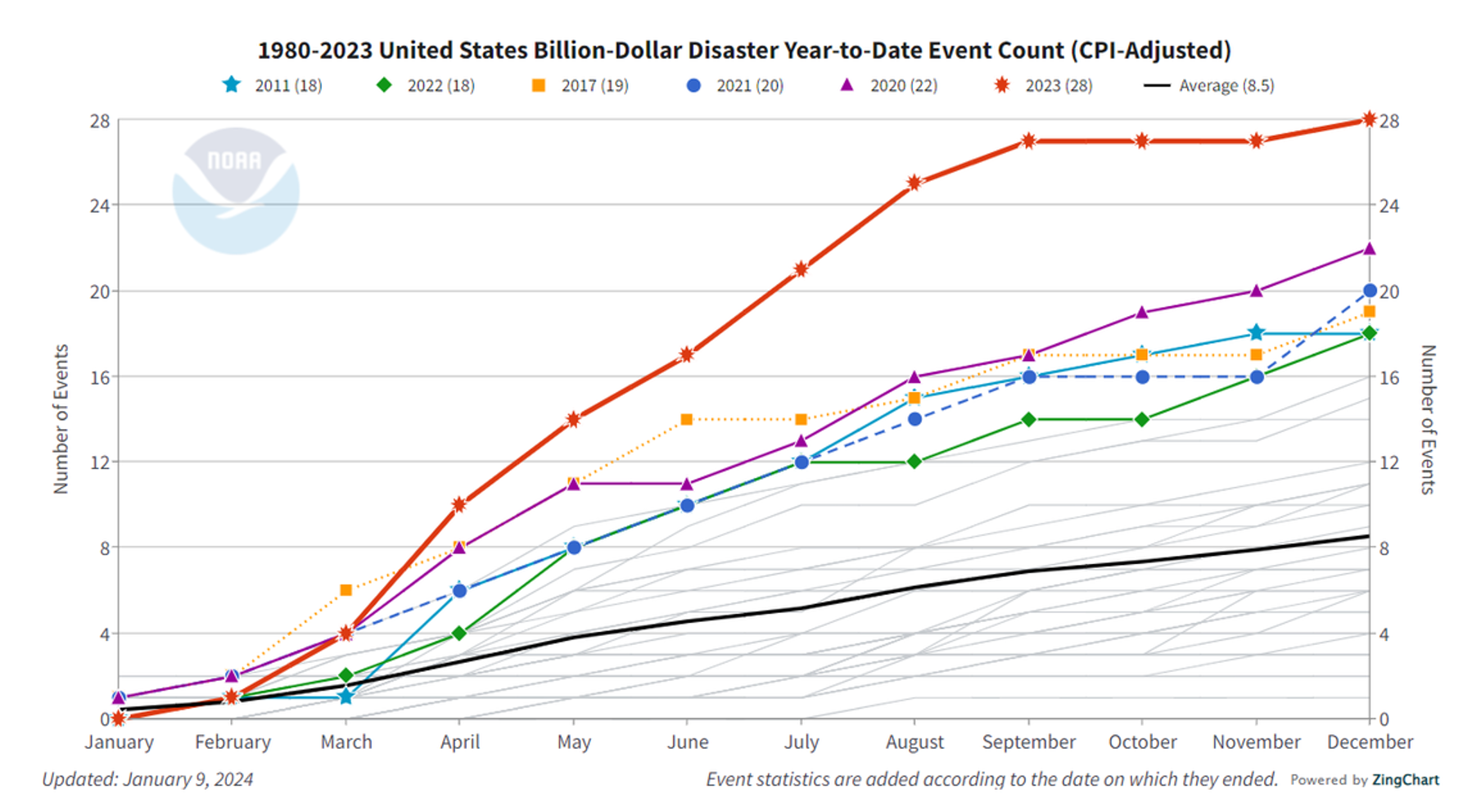

It will not have been lost on Australian market participants just how wet the South-East Coast summer has been this year and how many “once in 100 year” weather events have occurred in the last 5 years. These events have not been isolated to Australia. 2023 was an outlier in the USA for greater than $1bn weather disasters.

Source: NOAA

China (still the factory floor for the world) has also seen unprecedented rainfall this year (see below) which has been disruptive in particular to south-east China. So far we haven’t heard of any specific supply chain issues from our Australian companies, but at some point, this could become an issue.

Source: NOAA, NCEI

What strikes us is the potential second-order effects of this more extreme weather. Extreme weather events can lead to a myriad of issues in supply chains and increases in the cost of building capital projects (residential, commercial and infrastructure build). All householders can see the increases in their insurance premiums. Some of this is just socialisation of the increased cost of insuring some households against extreme weather events.

In the mining sector it can shut down production for days or weeks at a time. And recovery costs are often being incurred months and years after the record event.

Viewed on a global scale though, we can see that all of these individual discrete extreme weather events are likely to add up to sustained background inflationary pressure. No one isolated event will ever be called out for a “spike” in inflation, but taken in aggregate, disruptions to supply and a sustained increase in cost of doing business due to delays will lead companies to raise prices where they can. We learnt through covid that humans are incredibly adaptable and its likely that supply chains will simply shift and adapt to these impacts in the short term. But it stands to reason that the next-best options will probably be more expensive.

Voting Observations:

In the year to 31st December 2023 we cast 666 ballots for 128 company AGM’s. Of those, 18% were AGAINST votes, but this hides the fact that we voted against at least one resolution in 44% of the AGM’s (56 of the 128 AGM’s in total) we voted on.

Many of these AGAINST votes (again) related to Remuneration practices (both Remuneration reports and Equity issuance to executives or board members).

Disclaimer

This communication is prepared by Longwave Capital Partners (‘Longwave’) (ABN 17 629 034 902), a corporate authorised representative (No. 1269404) of Pinnacle Investment Management Limited (‘Pinnacle’) (ABN 66 109 659 109, AFSL 322140) as the investment manager of Longwave Australian Small Companies Fund (ARSN 630 979 449) (‘the Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Link to the Product Disclosure Statement: WHT9368AU

Link to the Target Market Determination: WHT9368AU

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Longwave, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Longwave, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Longwave and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Longwave. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Longwave.