Carbon, Slavery and Poker

– Melinda White, January 2022

Efficiently adapting an integrated ESG investment process to new information inputs is essential for investors. Richer information helps us identify hidden risks in company operations and focus our engagement on weak actors. In 2021, we enhanced our in-house ESG scorecards with carbon emissions and modern slavery information and learnt a few things along the way. AGM voting season prompted us to wonder if some companies deserve a meme song: If you don’t spill me baby I’ll do anything I want.

One of the persistent aspects of investing over the long term is that information inputs morph in response to corporate trends and regulatory reporting requirements. Investment processes need to adapt to this new information when it’s relevant to investment decisions. With this in mind, Longwave was founded with the intention of always keeping an eye on the horizon and adapting to new information inputs. Our core investment philosophy never changes (that Quality small cap companies outperform over the long term). But we recognise that if we can systematically capture new information early, it may enrich or enhance our decision making on the fundamental side of our investment process.

This need to adapt to new information is most obvious at the nexus of an integrated ESG approach. At the beginning of 2021 we observed the following changes in the ESG information landscape: carbon emissions data had significantly improved for small caps; companies have started to report their Modern Slavery approach and Sustainable Development Goals have started to turn up in company annual report commentary.

At Longwave, our fundamental stock valuations are directly impacted by ESG scores. As more information becomes available, our research management tooling has enabled us to bring in new data and adapt our scorecards as the information landscape morphs.

With this in mind, we set out at the beginning of 2021 to enhance our ESG scorecards with information on Carbon Emissions, Modern Slavery statements and SGD’s. We love learning new things about companies and this ESG enhancement is no exception. In this report we share what we set out to do and what we learned and a few thoughts about how we think the information needs of ESG focused investors are likely to change in the next couple of years.

Carbon

We’ve believed for many years that the early 2020’s would eventually be the turning point in the markets’ focus and understanding of the gargantuan global task that climate change transition represents. One of our ESG goals for 2021 was to be able to measure Scope 1 and 2 emissions reliably and accurately across our portfolio. Up until this year, accurate GHG emissions data for small-cap companies has been hard to come by and very few companies have been reporting emissions.

Our analytical needs are multiple and sit at both the portfolio and company level. We need to be able to:

- Compare company emissions relative to peers,

- Have a starting point from which to measure company improvements (evidence that a company is making changes to their operations),

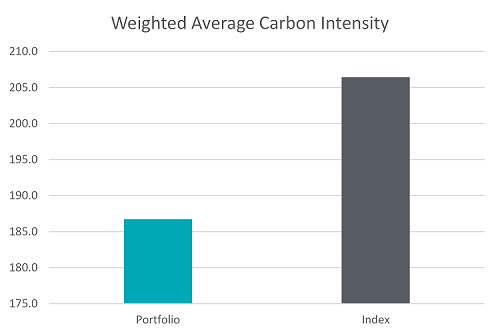

- View our portfolio Weighted Average Carbon Intensity (WACI) so that we can measure concrete change in our portfolios and,

- Price carbon risk at the company and portfolio level.

This year a dataset with reported and relatively high confidence estimates became available for the small-cap universe. We incorporated it into our research management platform and using that as a base, have cross-checked it against reported information and started a conversation with some of the larger companies in the small-cap universe who appear to be outliers. As always with data projects, we learnt a few things during the process:

- Disclosure in small caps is problematic relative to large caps

- Estimates provide a way of improving coverage but can still vary wildly from the actual disclosure. Data that doesn’t fit with our understanding of the business model has prompted us to engage with specific outlier companies.

- There’s a wide divergence across small companies in both their GHG emissions and the strategies management are employing to report and improve them.

We are now able to see (at the click of a button) the Weighed Average Carbon intensity of our portfolio vs the index both at the aggregate, sector and company level. We were pleased to see that the portfolio carbon intensity is lower than the index without having expressly controlled for emissions.

Source: Longwave Capital Partners, Company Reports, Bloomberg Estimates. 98% of the portfolio has either reported or estimated data as at 31 Dec 2021

We are also able to track changes in intensity through time.

Finally, we used this as an opportunity to think about how the data might be used to reward companies that are making a genuine difference to climate change transition. If we think from first principals about what has to change between 2020 and 2050, companies with emissions intensive operations will need to invest in their asset bases (probably out-of-cycle) to lower their emissions intensity. The role financial markets play in that equation is to both provide the capital necessary for the transition and to reward the improvers with a lower cost of capital. Alongside a transition of the existing asset base, financial markets have a role to play in funding new technology solutions in a range of energy market and industrial equipment verticals.

When we look at the Australian small cap universe, the companies with the lowest emissions intensity tend to be in that position naturally (due to business model or industry). As a result, they are unlikely to ever have a significant role to play in moving the economy further towards net-zero. Holding a portfolio of these carbon-light businesses might feel good, but in practical terms, your incremental capital investment (reinvested profit sitting inside each company you own) isn’t actually being spent on the effort to transition to net-zero.

On the other hand, some of the more emissions intensive businesses (such as Viva Energy) have a significant role to play in transitioning their asset base to net-zero and in the absence of government policy can choose to invest or not invest. We think companies who have higher emissions intensity but show big improvements year on year because they’re investing incremental capital to facilitate transition should be rewarded for their efforts. And we think investors who truly want to ensure their money is contributing to transition in the most impactful way should be thinking about how their captive incremental dollar of capital spend is being put to work.

Over 2022 and beyond we will use our new dataset to explore these ideas further.

Modern Slavery

In 2018 the Australian Government passed the Modern Slavery act. Any business with revenues over $100m is required to prepare a modern slavery report that outlines risk of exposure to modern slavery in the operations and supply chains of the company. These reports are supplied to the Australian Government and are generally made public on company websites. Our objective in incorporating Modern Slavery into our Social scorecard in 2021 was to analyse the statements produced by our portfolio holding companies and understand how each company identifies and manages the risks. Modern Slavery is what we think of as a slow-burn hidden reputational risk. A public exposure of particularly bad corporate actors has the potential to lead to large customer boycotts, fines or the need to re-point a global supply chain to higher cost suppliers. A better understanding of just how focused a company might be on these hidden risks can help us avoid or weight the portfolio away from companies with higher exposure.

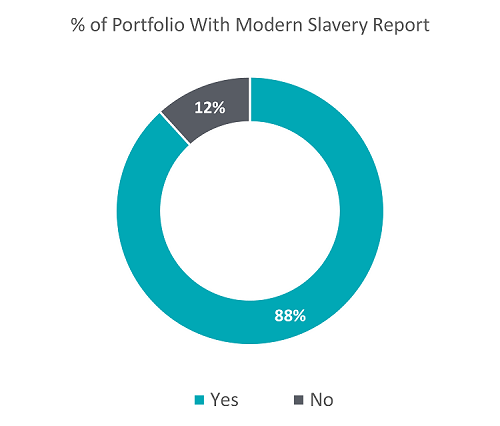

We are now able to see at the portfolio level, what percentage of our portfolio isn’t reporting on modern slavery. We will use this to guide some of our ESG engagement in 2022.

Source: Longwave Capital Partners, Company Reports. 75% of the portfolio has been surveyed at 31 Dec 2021

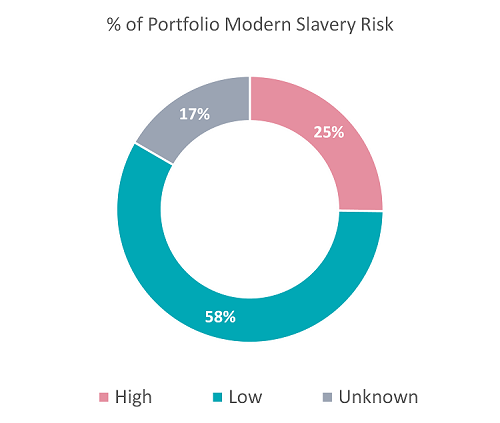

We are also able to see the categorisation of our portfolio (and each company) into high, low and unknown risk. Again, this will help us form targeted engagement in 2022.

Source: Longwave Capital Partners, Company Reports. 75% of the portfolio has been surveyed at 31 Dec 2021

This process was rich with learning outcomes:

- There was a wide range in the quality of reports. Some companies had gone to serious lengths to think about where hidden modern slavery might occur in their domestic supply chain and were already implementing targeted staff training so that everyone in their operations was equipped to spot the signs. Others were simply implementing a layer of relatively weak legal protections (supplier contracts) and didn’t appear to be methodically working through the best way to actually help eradicate the practice.

- Across the board, risk mitigation strategies tended to take the form of contractually requiring offshore suppliers to simply sign a statement that they complied with the Australian legislation. Best-practice risk mitigation appears to be using a respected global NGO to zero in on at-risk countries and industries and then contracting those NGO’s to do spot checks.

- We identified one company in the ‘software AI’ space that wasn’t producing a modern slavery statement despite our knowledge of the operations suggesting their supply chain is very likely to contain high risks.

We will use these learnings to further enhance our qualitative data capture on modern slavery over 2022.

Proxy Voting Observations

And finally to Poker. We are often blown away by the greed which can be on show in the annual ritual of renumeration reports and votes. Philosophically, we believe that its fine for management to be paid for performance, but our active voting policy clearly spells out that we need to see appropriate and transparent hurdles.

What’s unique about Australia is that shareholders have the 2-strikes and a board spill tool at their disposal (if greed morphs into avarice). Nine companies in our systematic portfolio this year had board-spill motions put to shareholders. But within that 9, three stood out and prompted a discussion of what we term board-spill poker. Board-spill poker is when a board decide (after a first strike), to make either minor or no changes to the renumeration structure and put it back to shareholders. We can only assume they are intending to call the bluff of the shareholder base (most likely under pressure from founder managers). The remuneration report votes are advisory only, so if shareholders are unwilling to use the consequence option as it was intended, it’s a toothless tool. In the absence of material personal consequences for being ‘bad actors’, the renumeration practices can continue unabated.

By way of example, a well known retail company received a 41% AGAINST vote to its renumeration report (second strike), but a full 95% of investors voted AGAINST the board-spill motion. We are happy to say that Longwave was in the 5% of investors who decided that a consequence tool needs to be used.

We will be interested to see the 2023 cycle of renumeration reports from these companies, but we wouldn’t be surprised if there is no material change to their renumeration practices.

Some of the significant vote issues we dealt with over the primary AGM season included 3 board spills, 2 shareholder resolutions and a range of renumeration structures that didn’t meet our standards.

A healthcare company we own continued to increase the CEO’s base salary above inflation, despite having awarded an extremely large LTI package in 2019, followed by a 75% base salary increase in FY20 and large one-off retention bonuses. We had voted for the CEO LTI package two years ago, however we believe base salary increases continued to be excessive. We felt if didn’t vote for a spill motion, the directors were unlikely to listen to a significant shareholder issue.

A resources company we own put the same renumeration framework to shareholders 2 years in a row after a 93% vote against the Rem report in 2020. The board spill was an easy decision to make; there had been no change to the company’s remuneration framework compared to the prior years and it really did solidify our concerns about board independence. We subsequently voted for board candidates (a mix of independent and major shareholder aligned) who we think will better align the renumeration structures to the economic interests of shareholders.

Another resources company we own had a shareholder resolution put up that would have required the company to disclose, in subsequent annual reporting, a plan that demonstrates how the company’s capital expenditure and operations for its coal assets will be managed in a manner consistent with a scenario in which global energy emissions reach net zero by 2050. We voted FOR this resolution as we believe that improved understanding of financial scenarios for capital allocation and cash flows back to shareholders under a net zero by 2050 scenario would be useful. It prompted us to think about a world in which coal asset-owners publicly publish their responsible shutdown plans matched to transition and how that might impact pricing of the equity. Unfortunately, the resolution was defeated.

Finally, a founder-led telecommunications business we own sought to issue options to non-executive and executive directors because of the dilution they had suffered after successive capital-raises to fund the company’s acquisitive growth strategy. The board of this company is non-independent. Executives and NED’s are adequately cash compensated, and Executives also have in place adequate STI and LTI structures. We voted against this options issuance as we didn’t believe the options were appropriate for directors. Options create alignment differences with shareholders which may compromise independence. Additionally, the reason proposed was to counter equity dilution from new acquisitions directors suffer – however all shareholders suffer similar dilution with no options granted, and it is the value accretion from the transaction which is required to add value over and above this dilution.

Looking into 2022, as we increase our standards and engagement on environmental and social issues we may use director voting as a way of communicating a lack of action by boards on these matters.

Download the complete ESG Observations and 1H2022 Proxy Voting Report

Disclaimer

This communication is prepared by Longwave Capital Partners (‘Longwave’) (ABN 17 629 034 902), a corporate authorised representative (No. 1269404) of Pinnacle Investment Management Limited (‘Pinnacle’) (ABN 66 109 659 109, AFSL 322140) as the investment manager of Longwave Australian Small Companies Fund (ARSN 630 979 449) (‘the Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Link to the Product Disclosure Statement: WHT9368AU

Link to the Target Market Determination: WHT9368AU

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Longwave, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Longwave, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Longwave and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Longwave. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Longwave.