How Longwave Integrate ESG

– David Wanis, July 2020

Longwave Capital Partners invests with a philosophy informed by the belief that for small caps, quality is a key driver of long-term investment outperformance. When we assess companies considering Environmental, Social and Governance (ESG) characteristics, we see them as markers of quality.

Historically, we have considered ESG as a component in the fundamental assessment that determines the quality of a business – factored into the quality score that we use to drive our valuation. This is calculated by applying a discount rate to our sustainable, mid-cycle earnings estimate in forecast year five. We believe the equity risk premium required of higher-quality companies is lower than average companies, and lower-quality companies require a higher equity risk premium than average.

While cognisant of the impact ESG factors have on the quality of a business (and thereby its value), our previous approach did not have the same objective level of data capture or comparability as the investment process that we now employ, driven by numerical and qualitative scorecard components. We addressed this in Q1 2020 through the implementation of a more thorough ESG process.

This enhanced process achieves the following:

- An exclusion screen that eliminates specific exposures from our portfolio,

- A consistent and formal process for the assessment of each ESG component,

- Scorecards that capture a combination of qualitative assessment and observable data to support the assessment by allowing comparability,

- Direct linkage between our ESG assessments and the quality score applied to each company (formalising the link between ESG and quality),

- The linkage of ESG to quality having a direct and measurable impact on our company valuations through the discount rate,

- Longwave Capital Partners’ status as a signatory to the UN Principles for Responsible Investment from Jan 2020

How ESG assessment fits with our existing investment process

Longwave has developed a rigorous and proprietary two-stage stock selection process in building a portfolio of quality small companies.

The first stage uses systematic fundamental assessments to identify companies that exhibit characteristics which have historically been high probability markers of failure or underperformance. These are low-quality companies we look to ensure are not present in our portfolio. Based upon our current criteria across the different models we employ, around 85% of the small caps we assess have a reasonable probability of failure or long-term underperformance. We construct a systematic portfolio of the remaining 15%, built from the ensemble of our different quality models.

It would appear at first glance that using available ESG data and testing for performance would be an appropriate measure to enhance our existing systematic process. Systematic processes allow investors to test many ideas. However, sound judgement is needed to discern whether a test should even be run in the first place. Though investors can easily be seduced by an attractive back-test, we refrain from running them unless we are confident the hypothesis and data available are likely to support a robust conclusion (good or bad).

Figure 1: Wet Roads Cause Rain

Source: Blackrock, 15,579 annual observations, April 2018

Our concern around testing ESG data at this time relates to:

- A lack of breadth and history of available data. Just as someone might search for their lost keys under the only available streetlight, we risk falling into the trap of testing what is readily available rather than what is important.

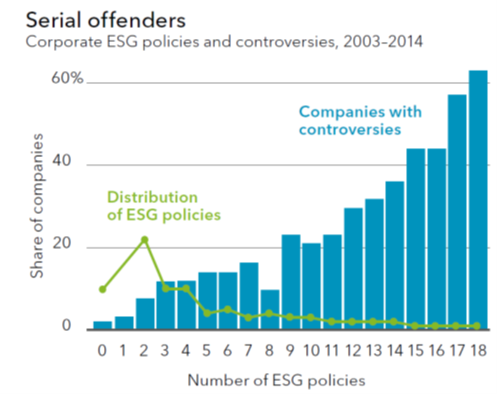

- Wet roads cause rain – sometimes the cause and effect are unclear or might even be inverted. For example, more controversies tend to occur at companies with the most ESG policies (exhibit 1). Compensating for poor underlying behaviour with box-ticking will give investors the wrong signal.

- A change in markets that could mean the impact on business and investment performance observed 10, 20 or 30 years ago may be very different to what occurs in the next 10, 20 or 30 years for many of these ESG-related behaviours. For example, consumers and employees today may make product, service and value choices based upon consideration of a broad range of ESG behaviours that were absent in the past. Allocators of capital are clearly incorporating this change in their marginal demand preferences.

There are a small number of ESG characteristics that we have reasonable data on and do believe have an enduring impact on company performance due to fundamental causal links (and where history is likely to be relevant in the future). We have built these characteristics into systematic models that we are currently observing out of sample and which may become a part of our systematic quality models in the future.

The second stage of our process is a fundamental company assessment where we analyse the companies in our systematic portfolio, as well as numerous stocks outside the model that may be of interest. Our fundamental process is comprised of confirming the view on quality suggested by the systematic process, determining the key value drivers for the business, and assessing qualitative factors such as ESG, management quality, competitive advantages and industry trends to ultimately arrive at financial forecasts for the business to estimate sustainable, mid-cycle cash flows. Once we have a more complete view on the quality of the business and the sustainability of the financial outcomes, we can better estimate its value and form a view based upon the pricing of the stock as to whether the company is attractively or unattractively priced from an investment perspective (and ask ourselves why this disconnect between price and value may have occurred).

Already, our fundamental process has distinct linkages between how we assess the quality of a business and the discount rate that we use to value its sustainable cash flow. This has allowed us to incorporate ESG more formally into our existing process through this quality / discount rate linkage.

The importance of comparability

An important consideration in constructing a portfolio from a large opportunity set is the ability to compare. Investors often get lost in debates about the “right” risk-free rate or the “right” equity risk premium etc. We have experienced first-hand just how easily the benefits of any perceived accuracy in setting macro variables can be washed away by compounded inconsistency elsewhere in the process. We work hard to preserve the ability to compare.

Investment ideas are researched and presented by teams of individuals. As much as teams try to standardise inputs to a process, the large number of judgements each analyst makes in arriving at a valuation for a security has an impact. The magnitude of this can be underappreciated as human judgement and bias are not readily observable. If investors are not careful in identifying the points of potential bias, the ex-ante alpha that appears to be embedded in price / value differences across the market can be nothing more than a reflection of analyst bias and inconsistency in the application of an investment process.

We make this point because we think it is prudent to start with a smaller number of high-impact ESG characteristics that we can evidence, capture, and compare. The alternative is something that appears far more impressive but introduces complexity and bias and results in a reduction in the comparability of our opportunity set.

The next issue is one of internally generated vs externally provided ESG assessment. We think there is a huge amount of great work being done on ESG matters by numerous specialist research firms, delivering actionable conclusions to investors. Embedding any external data into an investment process compounds the issue of comparability. The philosophy, process, framing, weighting, and judgements are all hidden from view and consolidated in a single score – arrived at through a process which may or may not be consistent with the rest of the existing investment process.

Exemplifying these comparability and hidden judgement issues, we have observed different providers arrive at very different conclusions for the same ESG factor and the same company. Like any component of an investment process, outsourcing can seem an efficient approach but losing control of assumptions and decisions may outweigh the near-term benefits.

Absence of Evidence is not Evidence of Absence

During the period we noted numerous smaller companies (market cap <A$300m) with seemingly limited levels of activity (by way of disclosure) in the areas of Environmental and Social activity.

At first glance, we considered these companies quite poorly, however, as the same issue kept repeating it became clearer that there was a pattern emerging where smaller and younger companies commonly had poor disclosure on E & S matters.

We contacted 17 of these companies to ask more about their disclosure practices and a very consistent response was;

- Here is a list of things we are doing and have done for many years that reflect a real commitment to both environmental and social goals and

- We have limited resources in preparing our annual report and have not adequately documented and disclosed all of these to shareholders to the level that reflects what we are doing.

Almost universally there was acknowledgement that future annual reports would contain greater disclosure on these areas, and we look forward to the release of 2020 annual reports to see if this has been improved.

We hope to report upon the improved disclosure from these companies in the near future.

Download the complete ESG Observations and FY2020 Proxy Voting Report

Disclaimer

This communication is prepared by Longwave Capital Partners (‘Longwave’) (ABN 17 629 034 902), a corporate authorised representative (No. 1269404) of Pinnacle Investment Management Limited (‘Pinnacle’) (ABN 66 109 659 109, AFSL 322140) as the investment manager of Longwave Australian Small Companies Fund (ARSN 630 979 449) (‘the Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Link to the Product Disclosure Statement: WHT9368AU

Link to the Target Market Determination: WHT9368AU

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Longwave, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Longwave, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Longwave and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Longwave. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Longwave.