Gradually, then suddenly: The evolution of retail

– David Wanis, April 2020

The world is always changing. For individuals change often feels like their reality is breaking, but change (in society, in economies and in markets) looked at from the vantage point of history looks more like continued evolution than the end-of-days.

As we sit here today on the cusp of going back to our pre COVID-19 lives (in Australia and New Zealand at least) we may see changes which will leave some bewildered and others wondering why it took a pandemic for the obvious to finally occur. In this commentary we will look at the Australian small cap retail sector. We own what we believe are some of the best quality Australian specialty retailers who are likely to deliver benefits to both their shareholders and their customers over many years as a result of the changes to their industry now in motion.

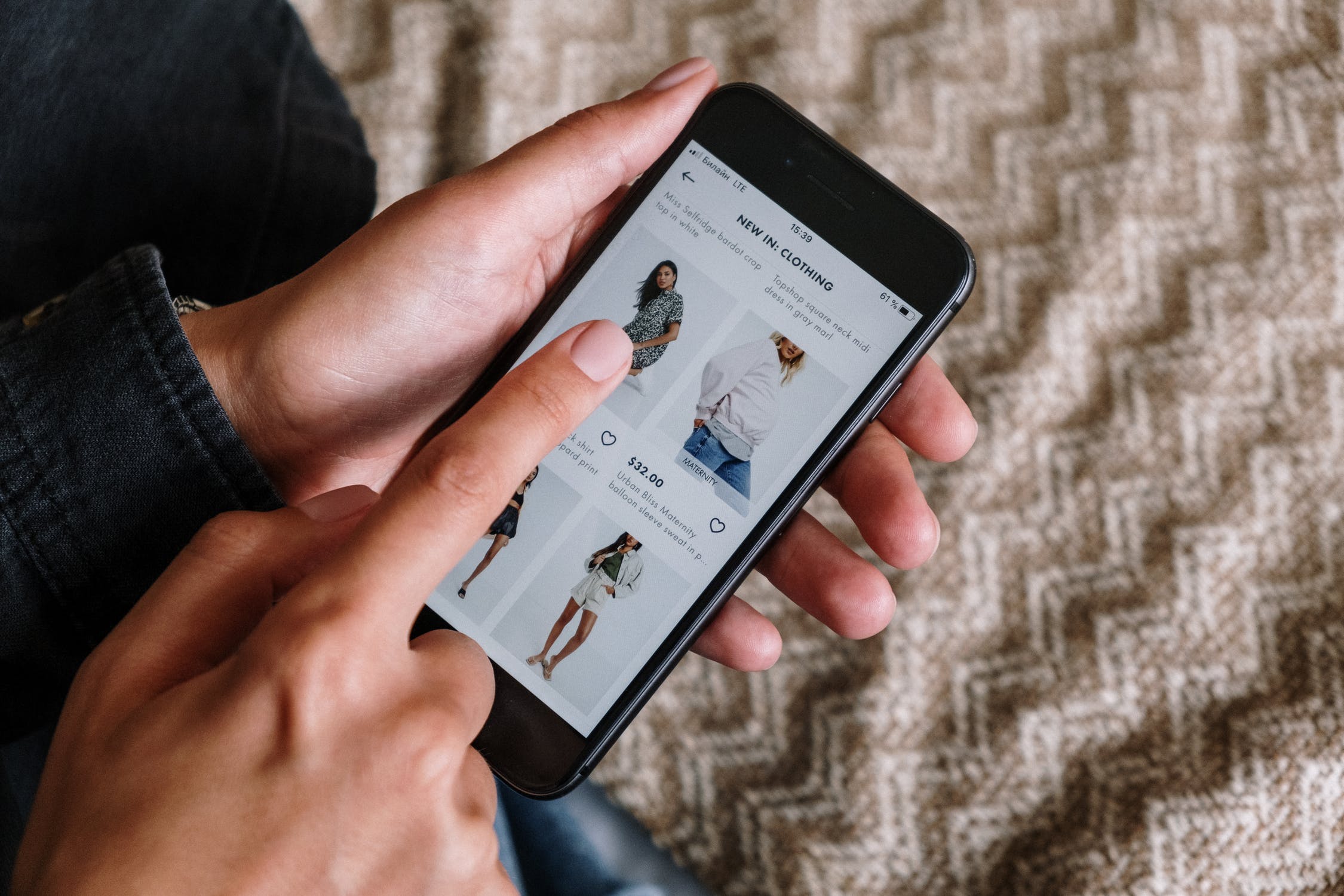

Accelerated by COVID-19, the way consumers use a mixture of in-store and online interaction with businesses may usher in a new era of omni channel retailing and change the industry structure for the first time since the ascension of shopping centres more than 50 years ago.

Technology and retailing

The influence of technological change on the retail business model is not new. The wide availability of plate glass windows, an Industrial Revolution in technology, fuelled the creation of the department store over 150 years ago. Even the observation of how this parallels with the modern Internet is not new, with the Productivity Commission Inquiry into Australian Retail in November 2011 noting; “retail in Australia has evolved considerably — driven by technological changes that range from the use of plate glass windows to aid goods display, inspection and price comparison in the early 19th century, to the advent of the internet in recent times which effectively provides a similar consumer service.”

Since 2011 the threat from global Internet players to Australian retailers hasn’t emerged as expected. The protection provided to domestic players from a currency almost halving and the entry by Amazon far slower and less aggressive than expected allowed local players time to observe, learn, adapt and build their own online businesses – under the umbrella of goodwill consumers attachment to their offline brands and funded by growing in-store profits. On almost any measure, the pace and achievement of these online endeavours was slower and less meaningful than it should have been – but a lack of competition meant in the end it may not matter.

In the nine years since the Inquiry, most small cap specialty retailers had built a reasonable online business (between 10-20% of sales) by the time COVID-19 hit and from announcements made so far the benefits of this channel have been very positive. Filling a near term earnings hole is nice, but the value in a true omni channel retailer – where they are best practice and competitive online as well as in-store – is to positively change the long term economics of the business.

As time progresses, we may see true omni channel as the only way a traditional retailer can survive. In-store only competitors may end up on the evolutionary scrap heap, like so many failed retail businesses that have come before. Considering Amazon was founded in 1994 it is remarkable more than 25 years later we are talking about this as a novelty, but for the P&L of most Australian retailers it still is.

The margin carrot for getting online right

The traditional business model of the modern specialty retailer looks roughly as follows. Products are purchased from branded manufacturers and augmented by some own brand versions that can lift margins should a consumer be swayed when they are in the store. The store itself is situated in a shopping centre and is filled not only with merchandise, but helpful employees to close the sale and collect the cash (or present the terminal for the tap). Controlling your cost of doing business (CODB) – rent and wages – is more about converting more of the sales into profits by being efficient. No sustainable advantage here given the power of shopping centre owners and non-negotiable legislated wage awards.

In a sector as diverse as retail, averages can be dangerous in practice but useful in illustration. Out of a dollar of sales, the average retail equity holders keep around 5- 10% pre-tax. Where does the other 90% go? Cost of goods (merchandise) accounts for 40-50%, rent 10-20%, employees 15-25% and depreciation, financing and corporate costs the rest.

They two key economic differences with online retailing relate to employee productivity (Kogan does 10x the sales per employee as Big W or Target and 5x that of JB Hifi) and rent expense (Westfields cost 10x the rent per sqm as warehouses, per the GPT Group property compendium).

Using these benchmarks for rent and employee productivity, a mix of 50% online and 50% in-store sales could unlock as much as 20% additional margin. Assuming some margin given back to consumers in the form of lower prices and reinvesment into online capability and fulfilment, sustainable margins moving from 5-10% to 10-15% or more with greater resilience is incredibly positive for the long term value of these businesses.

The higher quality specialty retailers we are invested in are experimenting and building towards this future for their customers and shareholders. They have been investing for many years and in the space of ten weeks much of this investment has been validated. Now emboldened they will likely accelerate. Not all will succeed, and the losers will likely be removed from the retail gene pool as happens regularly. The winners will be amongst the next generation of leaders in Australian retailing.

Disclaimer

This communication is prepared by Longwave Capital Partners (‘Longwave’) (ABN 17 629 034 902), a corporate authorised representative (No. 1269404) of Pinnacle Investment Management Limited (‘Pinnacle’) (ABN 66 109 659 109, AFSL 322140) as the investment manager of Longwave Australian Small Companies Fund (ARSN 630 979 449) (‘the Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Link to the Product Disclosure Statement: WHT9368AU

Link to the Target Market Determination: WHT9368AU

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Longwave, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Longwave, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Longwave and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Longwave. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Longwave.