Buy Australian

Investors are spoiled for choice. Every cycle there is a new investment theme, product or structure which is going to be the golden opportunity. A generation ago it was TMT. Then BRICS, structured products, disruption, smart beta, private assets. Artificial intelligence is just on the horizon, ready to be the thematic investment strategy that works for sure this time.

Forget all that. We think one of the single best opportunities for long term wealth compounding sits right under our noses. Easily accessed and low cost but overlooked due to familiarity.

We are talking of course about Australia and Australian Equities.

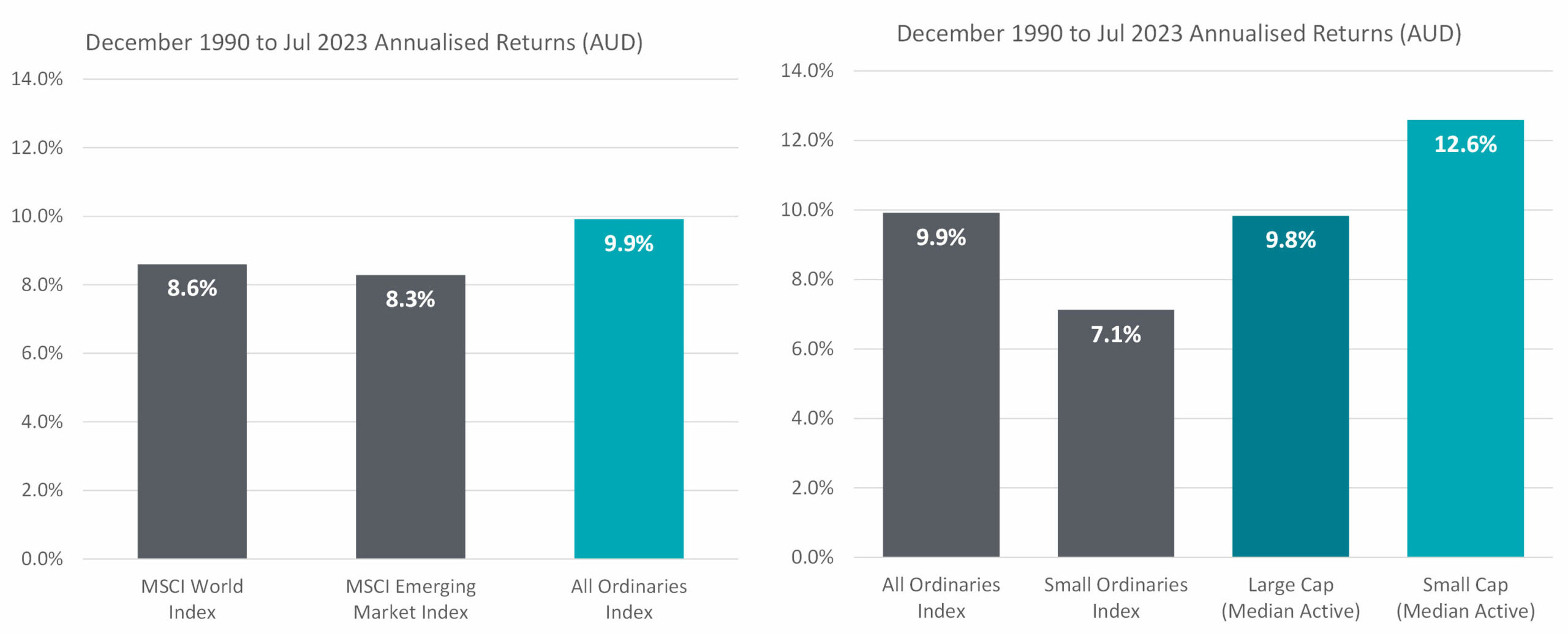

Now we are all for diversification but let’s not lose sight of the fact that over an investment generation (from 1990 to 2023) Australian equities (S&P / ASX All Ordinaries) have delivered total returns of 9.9% per annum, handily out pacing global equities (MSCI World Index) at 8.6% p.a, and emerging markets (MSCI Emerging Market Index) at 8.3% p.a.

And within Australian equities you can do even better. Over the same time, while the median large cap manager just kept sight of the index (9.8% p.a net of fees per Morningstar), the median small cap manager delivered 12.6% p.a net of fees over the same period. That return difference compounds over 33 years to more than double the wealth for the small cap fund investor relative to large caps.

| Source: MSCI, Bloomberg, Longwave Capital. Gross of Fees | Source: Morningstar, Longwave Capital. Index returns are gross of fees, fund returns are net of fees |

Australia could repeat the performance of the past

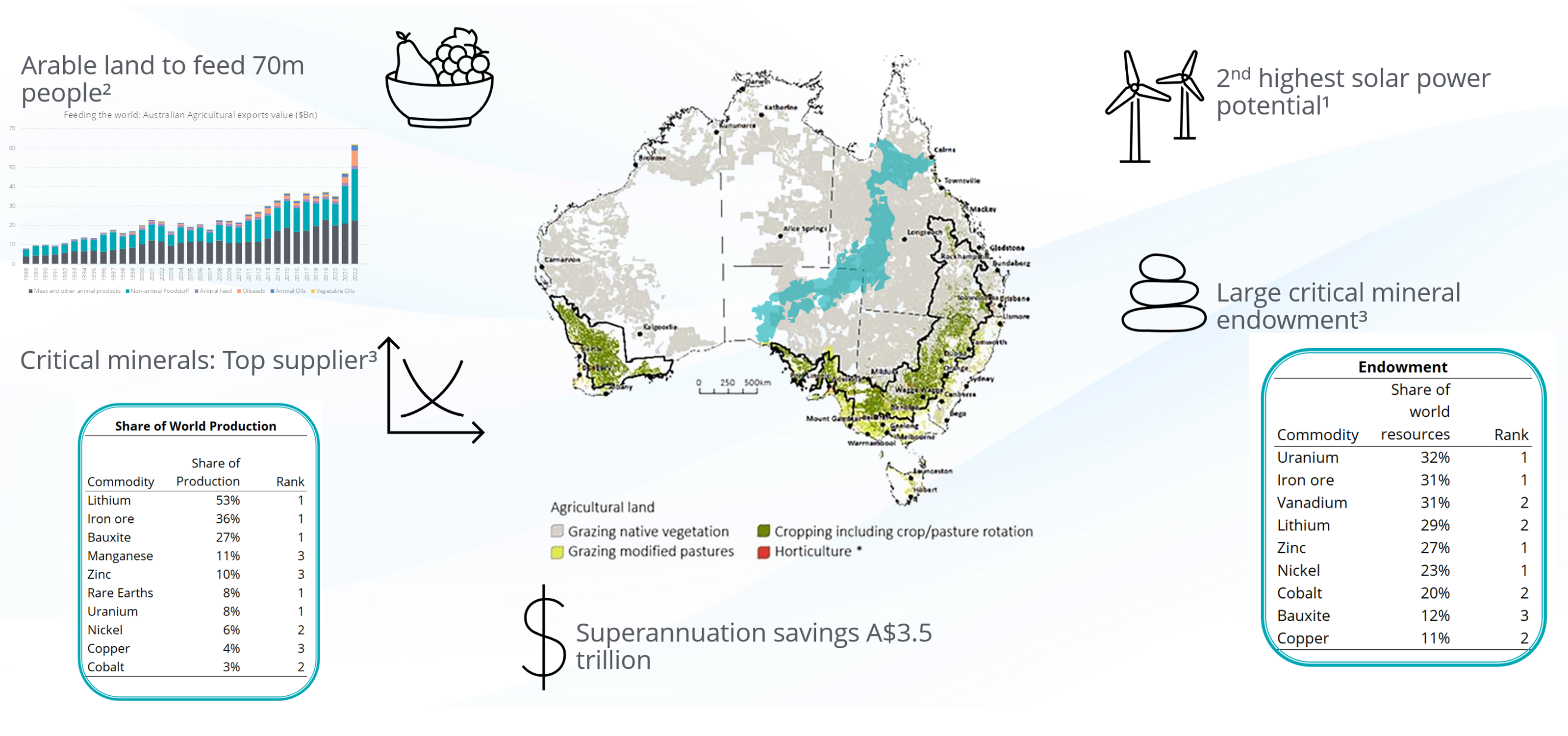

There are many factors that enable and support long term economic growth. Three high on the list are 1) demographics, 2) natural resources and 3) capital. In 2023 Australia remains developed-world-leading in all three.

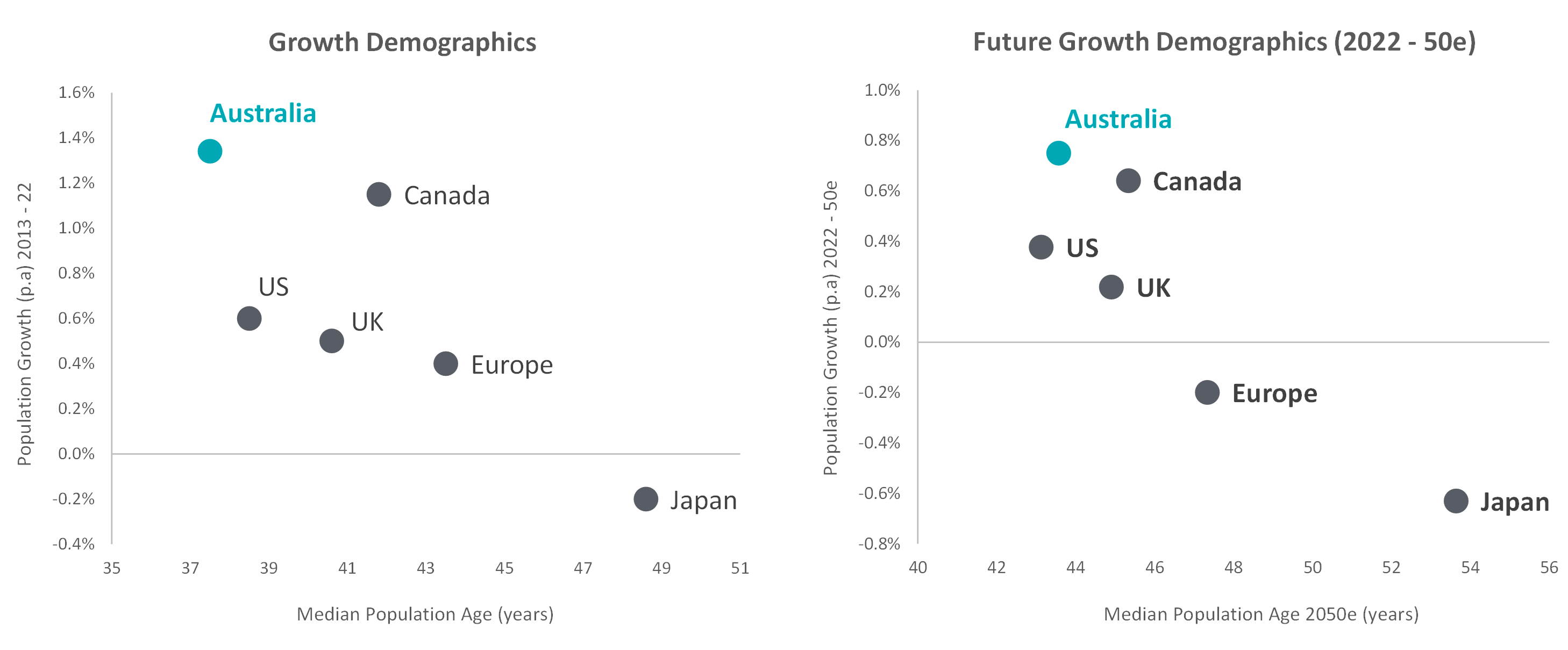

Our demographics are the envy of all other developed markets. We have a faster growing and younger population – expected to continue for at least the next 25 years. Australia is endowed with natural resources beyond mining. We grow enough food to feed 70m people. We have large critical transition mineral deposits (rare earths, lithium) and huge potential for solar power generation.

It is easy to get anchored to our past as a small country (population wise). Sure, a lot of Australia is desert, but we have arable, coastal land larger in size than all of Japan, housing less than a quarter their population.

Source: WorldData.info. Population growth from 2013 to 2022 and 2022 – 2050.

Source 1. Austrade & World Bank, Global photovoltaic power potential by country. 2. ABS & Longwave. 3. Geoscience Australia & Longwave.

Satellite Alpha: Emerging Markets vs Aussie Small Caps

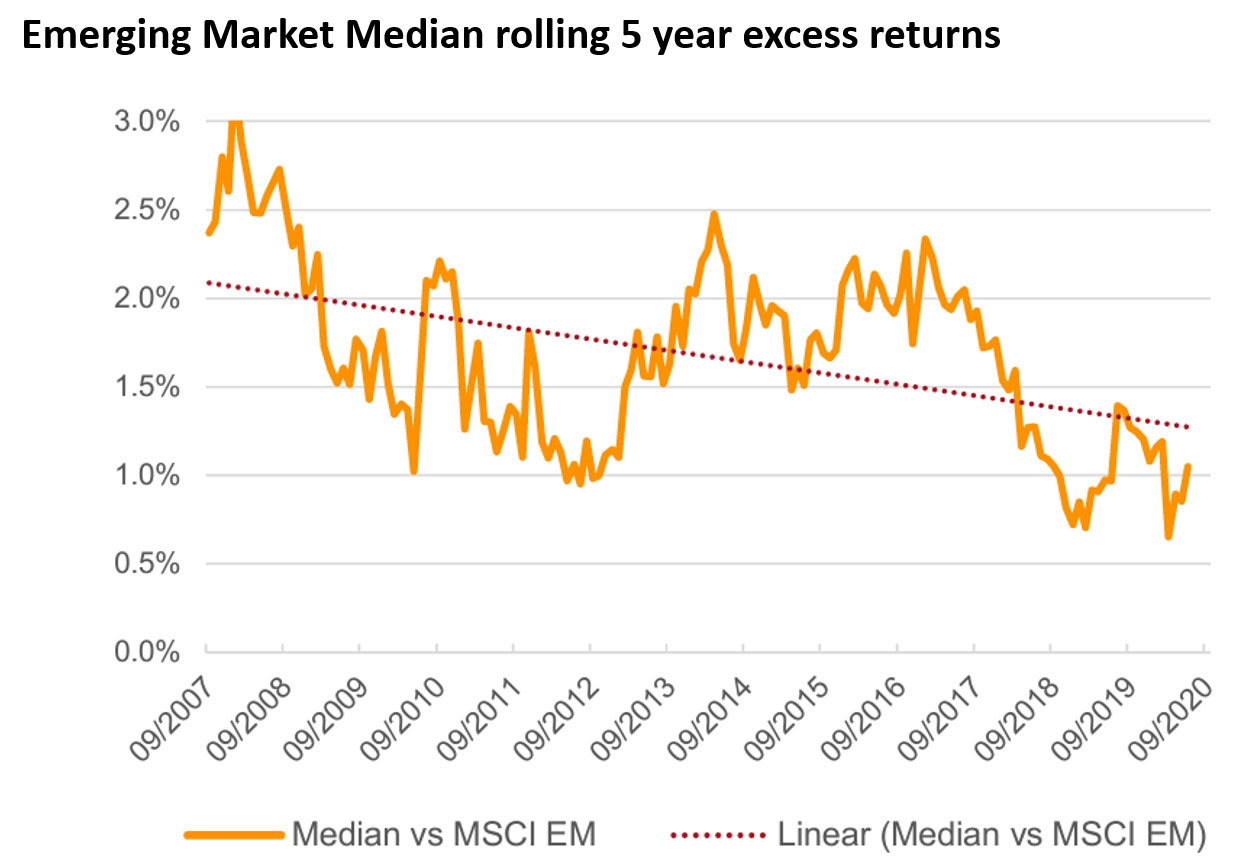

Some emerging markets (EM) have great demographics or abundant natural resources (and sometimes both in the same country), but there are many investment risks that come with them (sound government, rule of law, protection of property rights, weak corporate profitability and governance), which reflects in the long term returns of EM being lower than DM over three decades. We should be thankful in Australia that a few free tickets to a fancy waiting room are enough to mobilise the electorate against government corruption. We are still a long way from emerging market levels of grift. Active EM investors may be able to sufficiently reduce the portfolio drag from EM risks to extract higher than index returns, but with a recent downward trend in active EM alpha as these markets become more efficient, the future net of fee benefit for investors may be similar to the index.

Source: eVestment, Frontier, before fees

Source: eVestment, Frontier, before fees

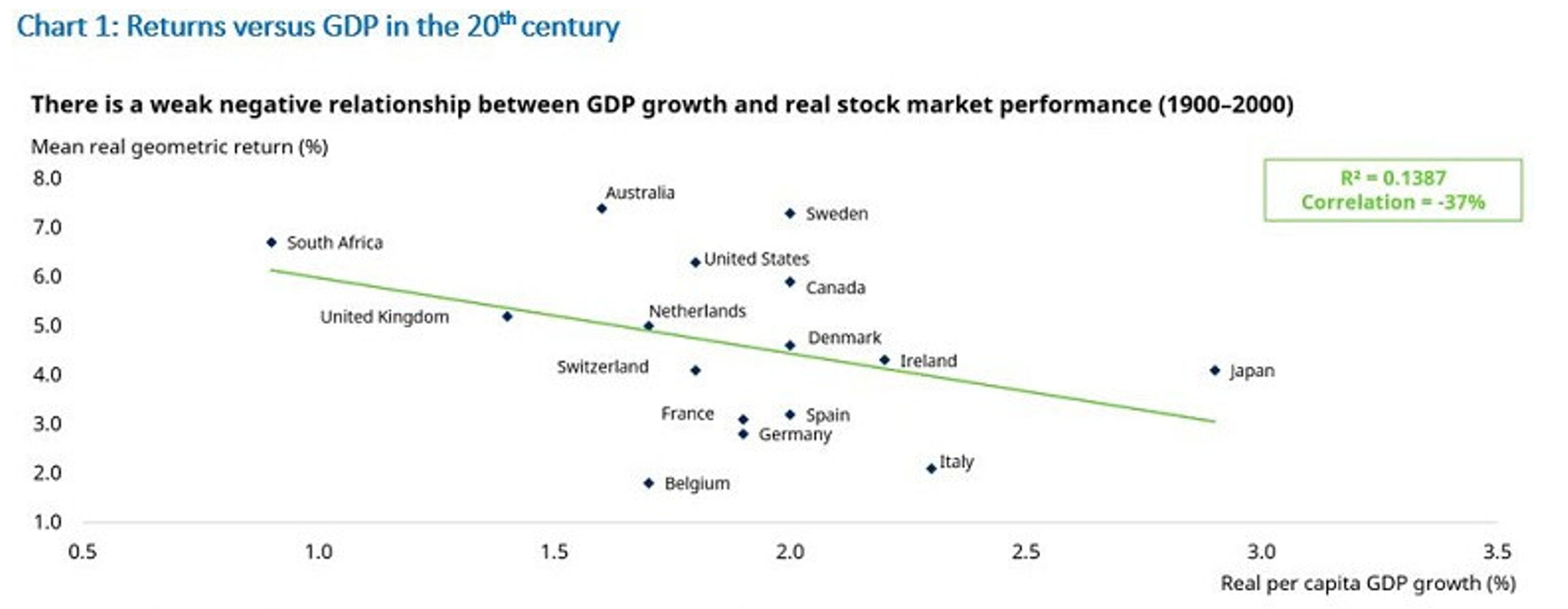

Economic growth is not the same as equity market returns (China is exhibit A for this). As we have seen, equity index returns are also not the same as the net of fee returns captured by investors in active funds.

Source: Dimson, Elroy, Marsh, Paul, Staunton, Mike, 2002. Triumph of the Optimists: 101 Years of Global Investment Returns. Princeton University Press, Princeton. Dimson, Elroy, Marsh, Paul, Staunton, Mike, 2003. Global Investment Returns Yearbook 2003.ABN Amro, Amsterdam.

Source: Dimson, Elroy, Marsh, Paul, Staunton, Mike, 2002. Triumph of the Optimists: 101 Years of Global Investment Returns. Princeton University Press, Princeton. Dimson, Elroy, Marsh, Paul, Staunton, Mike, 2003. Global Investment Returns Yearbook 2003.ABN Amro, Amsterdam.

Australian active small cap investors are wise to the long-term value added by active funds relative to the benchmark. This is a market that pays to be active.

Bad news sells

We will almost certainly have a recession at some point in the future. Lots of other bad things will also happen. Knowing what may happen and investing based upon an opinion of precisely when it will happen are two different things. It is no co-incidence there are no economists with worthwhile investment track records. Their opinions should be considered media content not investment advice.

There are always reasons to sell. There will always be pundits worried about the imminent collapse of something (the economy, markets, family values, their sports team, twitter). We know we have this bias ourselves – humans are hardwired to survive threats so we pay a lot of attention to them. We easily forget the journey over the past 33 years was filled with just as many fears as today, and active small cap funds delivered 12.6% per annum anyway.

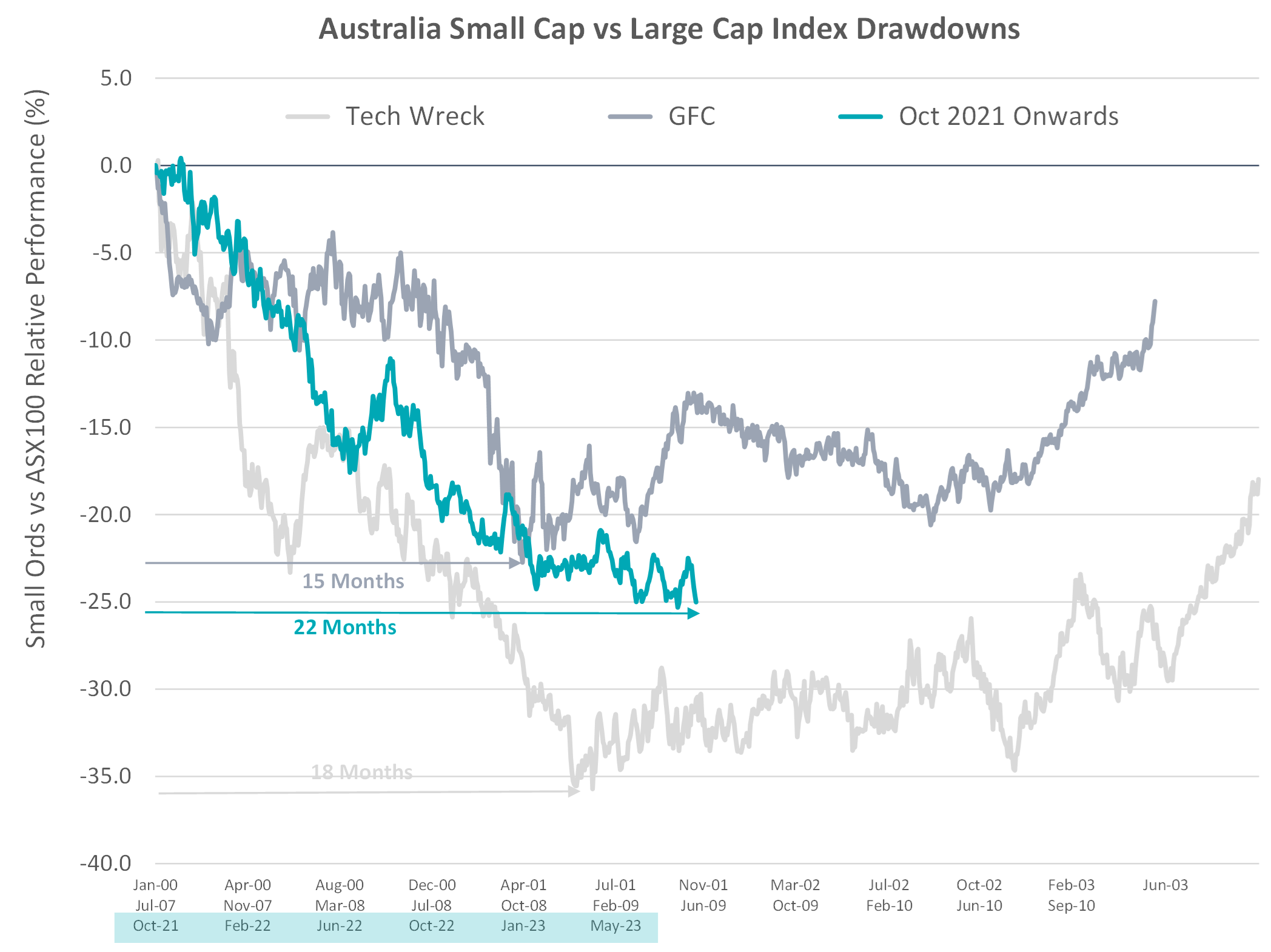

Australia will more than likely remain a wonderful place to live, grow a business and invest. Active small caps – despite the last couple of difficult years – are likely to return to being one of the best options for compounding wealth available to investors. And today they remain ‘on sale’.

Source: Bloomberg, Longwave Capital Partners. 31 August 2023. Starting point was the highest relative small cap index performance prior to drawdown.

Disclaimer

This communication is prepared by Longwave Capital Partners (‘Longwave’) (ABN 17 629 034 902), a corporate authorised representative (No. 1269404) of Pinnacle Investment Management Limited (‘Pinnacle’) (ABN 66 109 659 109, AFSL 322140) as the investment manager of Longwave Australian Small Companies Fund (ARSN 630 979 449) (‘the Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Link to the Product Disclosure Statement: WHT9368AU

Link to the Target Market Determination: WHT9368AU

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Longwave, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Longwave, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Longwave and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Longwave. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Longwave.