The Longwave Small Companies Fund increased by 5.0% during September 2024, underperforming the 5.1% increase in the S&P/ASX Small Ordinaries Accumulation Index benchmark by 0.1% over the month (after fees).

FUND PERFORMANCE TO 30 SEPTEMBER 2024

Small caps are the opposite of banks

Investors are probably sick of hearing about how unsustainably expensive Australian banks are in general and CBA in particular relative to the rest of the market. That CBA trades at a meaningfully higher P/E than Alphabet (Google) (23x vs 19x) is a very different picture to pre COVID when in 2018 CBA was on 13x and Alphabet was on 21x. Active large cap investors probably have many more ways to show how extreme these valuations are, but one story we heard repeatedly from financial advisers in September was “everyone told me CBA was expensive at A$100, and here we are nine months later at A$140 so I am glad I didn’t sell”. Behaviorally this makes investors less likely to sell due to the endowment effect and recency bias, but could make the decision to sell at A$140 even more valid than it was at A$100.

We don’t know. We are not large cap bank investors.

But it prompted us to do some digging into what the most extreme bank valuations many investors have seen in their careers may mean for small caps.

Banks are quintessential large caps. They are businesses that benefit from scale. They are in very well developed, mature, stable and slow-moving industries. They are heavily regulated. Governed and managed by committee. History shows if things go very poorly, the government is there to make sure the downside for equity holders is limited. That is not their explicit intention, but it has been the outcome.

Small caps are in many ways the opposite of banks. Their advantages are often in their smaller size, exposure to newer, less developed industries which are growing quickly. Executing at speed, with an incentivised management team – often founder rather than committee led – tends to correlate more with success that ongoing strategic reviews and input from management consultants. If things go poorly for small caps, shareholders are on their own. In many cases the downside is a total loss of capital.

Over the past four years there are two truths about the Australian market seared into the consciousness of investors: 1) Small caps have underperformed the ASX300, by a lot (-7% p.a) and for a long time and 2) Banks have outperformed the ASX300, by a lot (+14% p.a) and for a long time. These two themes have been so dominant that positioning relative to the benchmark in these two groups would have swamped almost any other investment decision you could make as an ASX300 benchmarked equity investor.

This dominates many investors framing of how to structure their broad Australian equity portfolios as we enter the final quarter of 2024.

We offer a couple of thoughts.

Small caps are decidedly not banks

One decision an investor may consider right now is to reduce their exposure to Banks. Given the outperformance, valuation and likely increased percentage of their portfolio, this would be a sensible decision. The second question though is what to invest into? What has historically performed well when banks underperform?

Small Caps.

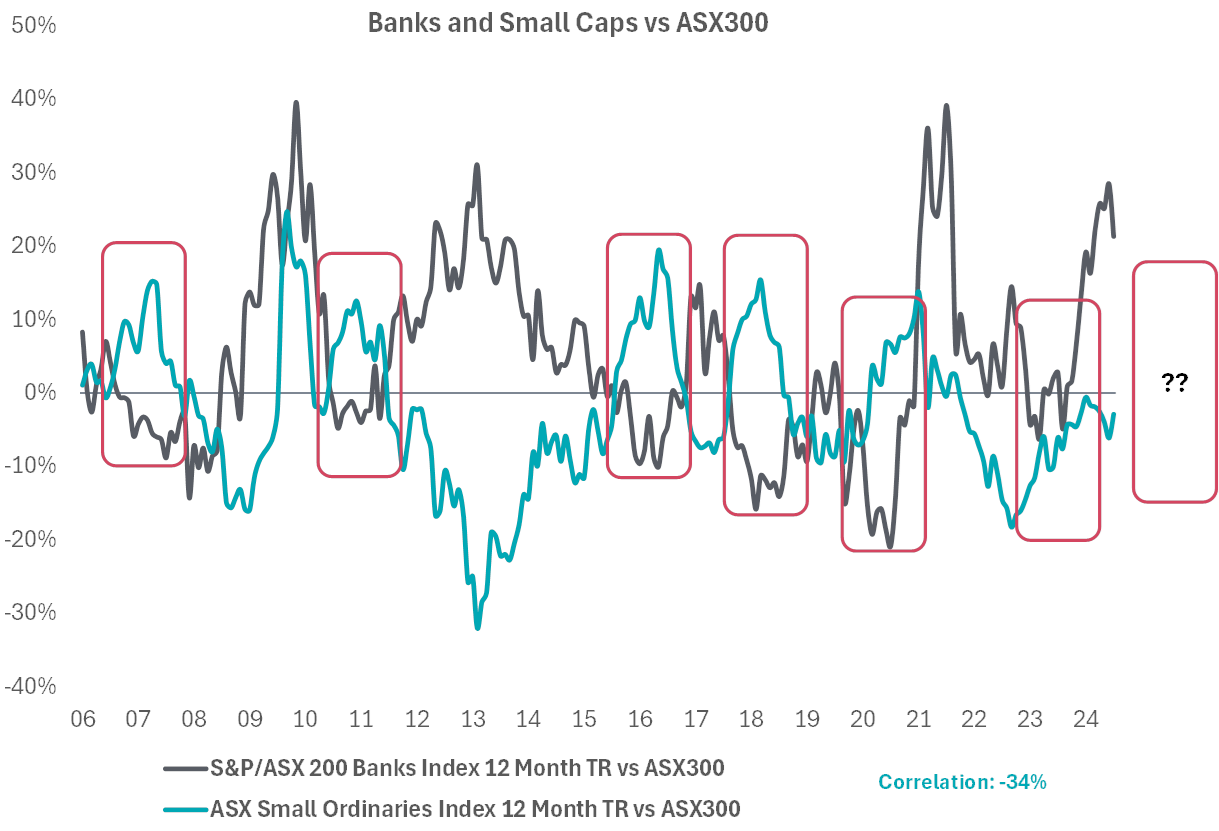

Since 2005, in five of the six periods when banks underperformed the ASX 300 by more than 5% over 12 months, small caps outperformed the ASX 300 by 10-20% over the same 12-month period. The one exception was mid-2023 when small caps were still in a COVID hangover bear market and bank underperformance was very short lived.

This also goes the other way. When banks are outperforming, five out of six times small caps are underperforming. The one exception was coming out of the GFC when receding credit risk saw both banks and small caps outperform the broader market.

For the numerically minded, the correlation between the 12-month excess returns to the ASX 300 between Banks and Small Caps is -34%. They are not the same at all.

Source: Bloomberg, Longwave Capital. Sep 2024

Big changes are afoot in the economy

Linking macro-economic developments to stock price performance is imprecise however we have noted some meaningful changes in the economy which may spark a change of market regime. We suspect this is more positive for small caps, but we don’t profess any specific insight here and may be biased in our interpretation.

Key changes we have seen:

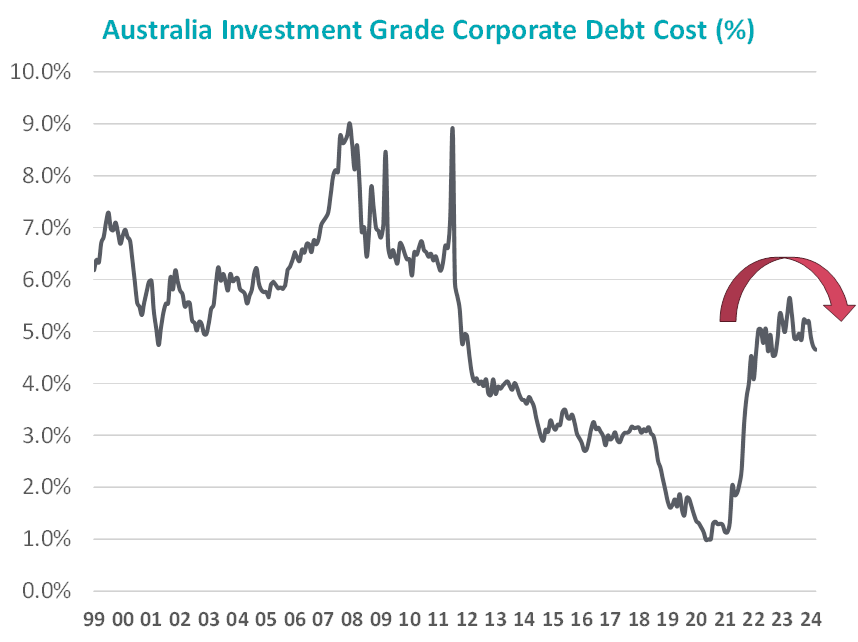

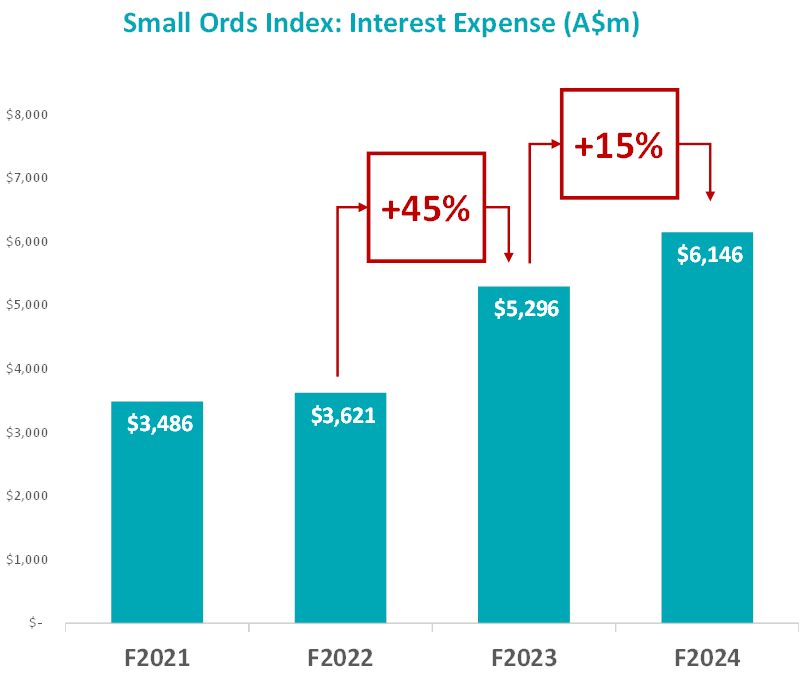

Interest rates are declining. September saw the first rate cut by the Fed, and although the RBA is holding rates for now, inflation is back in their target range and falling. The corporate bond market is already in front of this, with investment grade corporate borrowing costs (4.6%) already more than 1% below their late 2023 peak (5.7%) and below the average levels seen in both F2023 (4.8%) and F2024 (5.2%). Consumers have digested higher borrowing costs and investors saw increased interest expense erode EPS growth and pressure multiples. These headwinds are now abating and may turn into tailwinds as F2025 unfolds.

Source: Bloomberg, Longwave Capital Partners. 30th Sept 2024

Source: Bloomberg, Longwave Capital Partners. 30th Sept 2024

Tax cuts effective July 1, 2024: “The implementation of the Stage 3 tax cuts and further declines in inflation are expected to result in real incomes growing strongly in the second half of 2024.” RBA Statement on Monetary Policy, August 2024

Australian household wealth remains strong: “Real household net wealth has increased by 5 per cent over the past year and is 22 per cent higher than prior to the pandemic. The increase in wealth since the pandemic has been driven by strong housing price growth, additional savings by households during the pandemic and equity price increases.” RBA Statement on Monetary Policy, August 2024

China Stimulus: Small resources underperformed small industrials by 14% in the 12 months to Aug 2024 and 25% over the prior two years as the Chinese economy looked decidedly soft. China unleashed aggressive stimulus very shortly after the Fed cut, which in turn has highlighted the potential cyclical upswing in commodity demand and pricing. Supply growth in most commodities other than lithium has been modest.

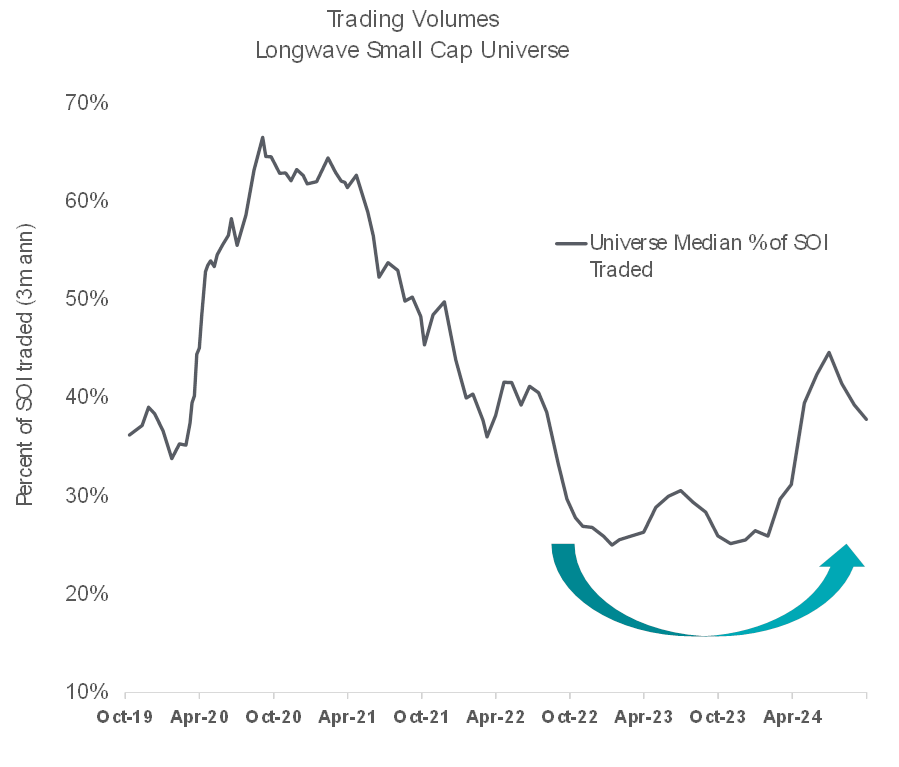

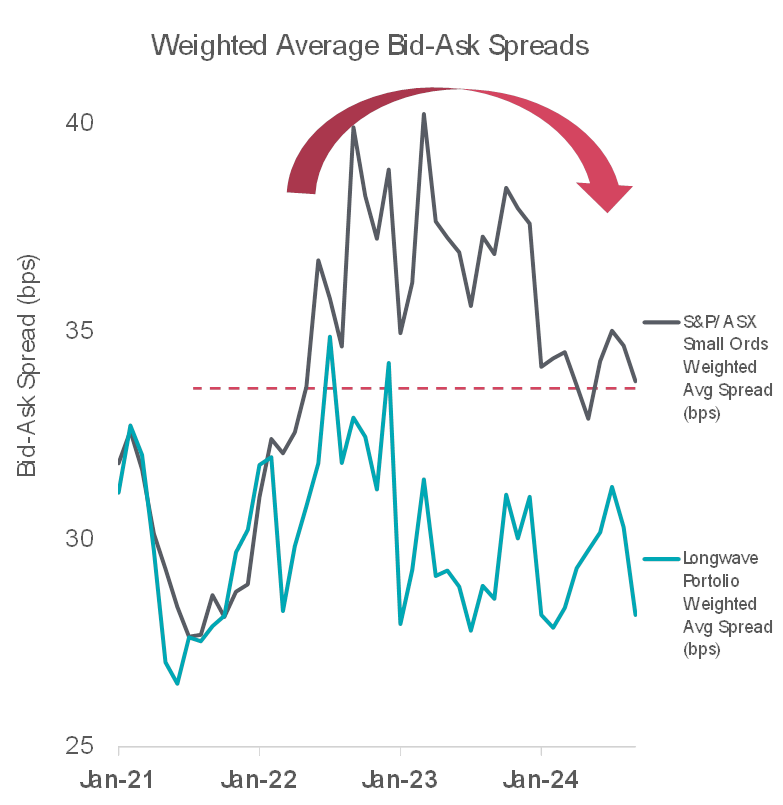

Liquidity in small caps has returned. Stock turnover has improved off the low levels of 2022 and 2023 and bid-ask spreads have also tightened. Both measures we see at normal levels now.

Source: Bloomberg, Longwave Capital Partners. 30 Sep 2024. Longwave small cap universe includes ASX and NZ listed securities outside of the S&P/ASX100 index with a minimum market cap of A$25m.

Source: Bloomberg, Longwave Capital Partners. 30 Sep 2024. Longwave small cap universe includes ASX and NZ listed securities outside of the S&P/ASX100 index with a minimum market cap of A$25m.

Real interest in small caps is increasing. A less objective measure, but we are hearing more active large cap managers talk about their best ideas being in the small and mid-cap market. We are seeing increased attendances at small cap events.

Small cap investors have been in a bear market for so long, many have forgotten what a bull market looks and feels like. The multi-year (rather than just multi-day) outperformance driven by strong EPS growth and P/E multiples re-rating. A vibrant IPO market. The rewards from investing in dynamic, growing businesses exposed to new technology, new industries and new business models. Double digit returns over many years for investors.

Portfolio Positioning And Performance 1

We made several changes to the portfolio in September. Given the underperformance in small resources and improved valuations, we increased positions across this sector in copper, gold and energy stocks. We had no specific insight on what may happen in China, but fortunately we mostly bought before the stimulus was announced. We also added a number of new technology and real estate names to the portfolio. This was offset by a reduction in exposure to financials and healthcare. As we also noted last month, the digestion of results in August can take more than a few days, and a number of stocks that closed the month below their pre-result share prices (we named HVN as one example, but there were many) have more than recovered and are trading above pre-result prices and well above the post result reaction lows.

1Illustrative only and not a recommendation to buy or sell any particular security.

TOP 10 HOLDINGS

FUND AND BENCHMARK SECTOR WEIGHT (%)

STOCK ATTRIBUTION (ALPHABETICAL)

2The Fund may also hold unlisted securities.

INVESTMENT OBJECTIVE

The Fund aims to outperform the S&P/ASX Small Ordinaries Accumulation Index over the long term.

The Fund aims to provide long term capital growth through investment in a diversified portfolio of highquality Australasian small companies (outside S&P/ASX 100 Index at time of investment or expected to be within six months).

INVESTMENT STYLE

Longwave’s investment philosophy is underpinned by the belief that the stocks of high-quality small companies outperform the benchmark over time, and as such, an active approach to investing in high-quality stocks provides value to investors who might otherwise have invested passively.

Longwave believes in the value of a deep and fundamental understanding of the securities in which we invest.

Disclaimer

This communication is prepared by Longwave Capital Partners (‘Longwave’) (ABN 17 629 034 902), a corporate authorised representative (No. 1269404) of Pinnacle Investment Management Limited (‘PIML’) (ABN 66 109 659 109, AFSL 322140) as the investment manager of Longwave Australian Small Companies Fund (ARSN 630 979 449) (‘the Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Link to the Product Disclosure Statement: WHT9368AU

Link to the Target Market Determination: WHT9368AU

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Longwave, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Longwave, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Longwave and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Longwave. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication. This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Longwave.

Lonsec Disclaimer:

The Lonsec Ratings (assigned as follows: Longwave Australian Small Companies Fund – assigned October 2022) presented in this document are published by Lonsec Research Pty Ltd (‘Lonsec’) (ABN 11 151 658 561, AFSL 421445). The Ratings are limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial products. Past performance information is for illustrative purposes only and is not indicative of future performance. They are not a recommendation to purchase, sell or hold Longwave Capital Partners Pty Ltd products, and you should seek independent financial advice before investing in these products. The Ratings are subject to change without notice and Lonsec assumes no obligation to update the relevant documents following publication. Lonsec receives a fee from the Fund Manager for researching the products using comprehensive and objective criteria. For further information regarding Lonsec’s Ratings methodology, please refer to Lonsec’s website at https://www.lonsec.com.au/investment-product-ratings/.

Zenith Disclaimer:

The Zenith Investment Partners (‘Zenith’) (ABN 27 103 132 672, AFSL 226872) rating (assigned Longwave Australian Small Companies Fund – March 2023) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.